Shoal Games Ltd. Announces First Quarter Results

Shoal Games Ltd. Announces First Quarter Results

ANGUILLA, B.W.I., May 9, 2016 / Shoal Games Ltd. (TSXV:SGW) (OTCQB:SGLDF) http://www.shoalgames.com (“the Company”), owner of Trophy Bingo (http://www.trophybingo.com), a mobile game live in the Apple, Google and Amazon App Stores, and Garfield Bingo, currently in production and scheduled for a Q4 2016 release, today announced its unaudited financial results for the first quarter ended March 31, 2016. All amounts are presented in United States dollars and are in accordance with United States Generally Accepted Accounting Principles.

Recent Shoal Games Ltd. highlights include:

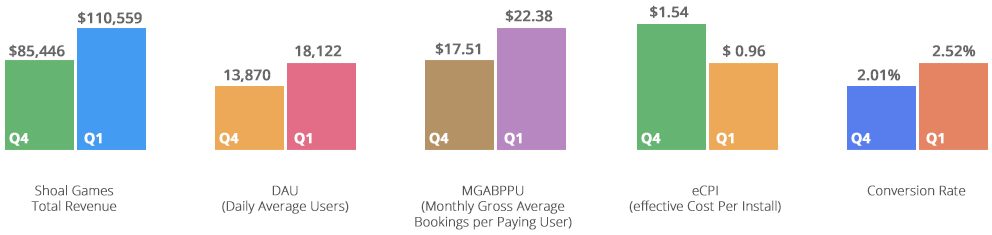

- Total revenue for the quarter ended March 31, 2016, was $110,559, an increase of 29% from revenue of $85,535 in the fourth quarter of 2015.

- Sales and marketing expenses from continuing operations were $201,587 for the quarter ended March 31, 2016, a decrease of 40% from sales and marketing expenses of $337,130 in the fourth quarter of 2015.

- MGABPPU (Monthly Gross Average Bookings Per Purchasing User) was $22.38, an increase of 28% from MGABPPU of $17.51 in the fourth quarter of 2015.

- Subsequent to the quarter ended March 31, 2016, the Company secured the brand rights to produce Garfield Bingo.

- Subsequent to the quarter end, the Company closed the first phase of it’s $2 million private placement for 1,504,600 common shares at $0.60 / share which raised proceeds of CAD$ 902,760.

“During the first quarter of 2016 the Company was actively engaged in development and marketing of Trophy Bingo as we continue to position the game to become a top performer,” said Jason Williams, the Company’s CEO. “Our efforts were successful as we grew revenues by 29% despite a 40% decline in marketing spend. Trophy Bingo’s capacity to earn continues to increase with our conversion rate climbing 25% to 2.52% in Q1 from 2.01% in Q4 and MGABPPU (Monthly Gross Average Bookings Per Purchasing User) rising 28%. Trophy Bingo is increasingly attracting free organic and viral installs with our eCPI (effective Cost Per Install) falling to $0.96 in Q1 from $1.55 in Q4 which when combined with retention increases helped to swell our average DAU (Daily Active Users) by 31% to 18,122 for the quarter from 13,870 in Q4, 2015.”

We continue to invest in the development of our proprietary mobile bingo system upon which Trophy Bingo is built,” continued Williams. “The system’s capability to monetize and retain continues to increase as we release more features, game modes, and content expansions. As previously announced, the Company has secured a license to produce Garfield Bingo which is scheduled to launch early in Q4, 2016. Garfield Bingo will launch on the same system as Trophy Bingo and will benefit from the time our teams have invested in configuring and tuning Trophy Bingo. We anticipate that the global reach of the Garfield brand will generate significant organic and viral installs which will result in a large increase in DAU on our platform. During the second quarter of 2016 we will continue to grow our DAU in a cost effective manner and enhance the underlying system as we work to develop Garfield Bingo and complete our private placement to fund the growth of our player base and revenues.”

Total revenue, net of platform fees to Apple, Google and Amazon for the quarter ended March 31, 2016, increased to $110,559, an increase of 29% from Total revenue of $85,535, in the fourth quarter of 2015 and an increase from revenue from continuing operations of $8,692 for the first quarter of 2015. The increase in Total revenue compared to the first and fourth quarter of fiscal 2015, is due to the Company launching a full global release of a feature complete Trophy Bingo in the Google Play and Apple App Store in the latter half of the third quarter of fiscal 2015 thereby increasing the number of players playing Trophy Bingo.

Sales and marketing expenses were $201,587 for the quarter ended March 31, 2016, a decrease of 40% from sales and marketing expenses of $337,130 in the fourth quarter of 2015 and an increase over expenses of $46,276 from continuing operations in the first quarter of 2015. The decrease in selling and marketing expenses in the quarter ended March 31, 2016 compared to the fourth quarter of fiscal 2015, was due to a controlled reduction in player acquisition costs after a larger marketing campaign in the fourth quarter of fiscal 2015 for the global release of Trophy Bingo. The increase in sales and marketing expenses in the quarter ended March 31, 2016, compared to the first quarter of fiscal 2015 was due to minimal trial marketing expenses in Q1, 2015 prior to the full global release of Trophy Bingo in Q3, 2015. Selling and marketing expenses from continuing operations principally include publishing services and user acquisition costs to acquire new players for Trophy Bingo.

The net loss after taxation for the quarter ended March 31, 2016, amounted to ($633,868), a loss of ($0.01) per share, and a decrease of 23% compared to a net loss of ($818,899), or ($0.01) per share in the fourth quarter of fiscal 2015 and net loss from continuing operations of ($737,965) or ($0.01) per share in the quarter ending March 31, 2015.

We had cash of $151,697 and negative working capital of $59,042 at March 31, 2016. This compares to cash of $570,086 and positive working capital of $454,447 at December 31, 2015. Subsequent to the quarter ended March 31, 2016, the Company completed the first phase of it’s CAD$2 million private placement for 1,504,600 common shares at CAD$0.60 per share which raised proceeds of CAD$ 902,760. The second phase of the private placement is scheduled to close May 31, 2016.

For full details of the Company’s operations and financial results, please refer to the Securities and Exchange Commission website at www.sec.gov or the Shoal Games Ltd. corporate website at http://investor.shoalgames.com or on the www.sedar.com website.

About Shoal Games Ltd

Shoal Games Ltd. (TSXV:SGW) (OTCQB:SGLDF) http://www.shoalgames.com is the parent company of the group of companies, which owns Trophy Bingo (http://www.trophybingo.com), live in the Apple, Google and Amazon App Stores, and Garfield Bingo, in production and scheduled for a Q4 2016 release. Both games are built on the Company’s innovative proprietary free-to-play mobile game system that brings unique gameplay and industry leading monetization techniques to the bingo category which is both high growth and high value. Garfield Bingo, once released, and Trophy Bingo are free to download and earn revenue through in-app purchases and in-game advertising. Shoal Games Ltd. trades on the TSX Venture exchange in Canada and the OTCQB venture marketplace for companies that are current in their reporting with the U.S. regulator. Investors can find real time quotes and market information for the Company at http://web.tmxmoney.com/quote.php?qm_symbol=SGW and http://www.otcmarkets.com/stock/SGLDF/quote.

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements. Certain information included in this press release (as well as information included in oral statements or other written statements made or to be made by the company) contains statements that are forward-looking, such as statements relating to anticipated future success of the company. Such forward-looking information involves important risks and uncertainties that could significantly affect anticipated results in the future and, accordingly, such results may differ materially from those expressed in any forward-looking statements made by or on behalf of the company. For a description of additional risks and uncertainties, please refer to the company’s filings with the Securities and Exchange Commission. Specifically, readers should read the Company’s Annual Report on Form 10-K, filed with the SEC on March 17, 2016, and the prospectus filed under Rule 424(b) of the Securities Act on March 9, 2005 and the SB2 filed July 17, 2007, and the TSX Venture Exchange Listing Application for Common Shares filed on June 29, 2015 on SEDAR, for a more thorough discussion of the Company’s financial position and results of operations, together with a detailed discussion of the risk factors involved in an investment in Shoal Games Ltd.

For more information contact:

- Henry Bromley

- CFO

- ir@shoalgames.com

- (888) 374-2163